The Repo Rate is the interest rate at which the central bank lends money to commercial banks with the idea of regulating credit availability. While the reverse repo rate is the rate at which a commercial bank lends funds to the central bank. Both of these are a major tool of monetary policy that helps to maintain a monetary balance and fosters a balanced financial system. The repo rate and reverse repo rate are decided by the Reserve Bank of India quarterly after consulting the government and considering real-time data. In this blog, we will delve into how both, Repo Rate and Reverse Repo Rate work.

What is Repo Rate?

The Repo Rate, denoted by the acronym ‘Repo’ which stands for ‘Repurchase Option,’ is the interest rate set by central banks for lending money to commercial banks, playing a pivotal role in monetary policy. This rate serves as a crucial tool for central banks to regulate credit availability, thereby impacting the money supply and inflation. It stands as a prominent mechanism for maintaining economic stability, controlling inflation, and fostering a balanced financial system.

Whereas, the Reverse Repo Rate is the interest rate at which the commercial banks lend funds to the central bank. These rates play a crucial role in liquidity management by providing a mechanism for banks to park excess funds. This helps control the money supply, supporting central banks in stabilizing inflation and interest rates. The Reverse Repo Rate serves as a tool to absorb surplus liquidity thus maintaining monetary equilibrium and ensuring efficient liquidity.

Current Repo Rate & Reverse Repo Rate Set by the RBI in India (2025)

In the Monetary Policy conducted by RBI on 06th December 2023, the bank has decided the repo rate as 6.50%. Whereas, the reverse repo rate was decided at 3.35%.

| Components | Rate for 2025 |

| Current Repo Rate: (7th Feb 2025) | 6.25% |

| Reverse Repo Rate: (21st Jan 2025) | 3.35% |

| Bank Rate: | 5.15% |

| Marginal Standing Facility Rate: | 6.75% |

RBI Repo Rate Cut History:

The RBI sets the Repo Rate for each quarter after consulting with the government. The table below can be checked to learn about the quarter-wise repo rate:

| Year of Interest | RBI Repo Rate |

| 6th December 2024 | 6.50% |

| 18th Sept 2024 | 6.50% |

| 8th Feb 2024 | 6.50% |

| 8th December 2023 | 6.50% |

| 10th August 2023 | 6.50% |

| 8th June 2023 | 6.50% |

| 6th April 2023 | 6.50% |

| 8th February 2023 | 6.50% |

| 7th December 2022 | 6.25% |

| 30 September 2022 | 5.90% |

| 08 June 2022 | 4.90% |

| 04 May 2022 | 4.40% |

| 22 May 2020 | 4.00% |

| 27 March 2020 | 4.40% |

| 04 October 2019 | 5.15% |

| 07 August 2019 | 5.40% |

| 06 June 2019 | 5.75% |

| 01 August 2018 | 6.50% |

| 06 June 2018 | 6.25% |

| 02 August 2017 | 6.00% |

Significance and Impact of Repo and Reverse Repo Rates

The Repo Rate is a critical tool of the Monetary Policy that is used to control inflation and maintain economic stability. The bank adjusts the Repo Rate to influence the borrowing cost for commercial banks thus affecting the interest rates. A high repo rate is used to deter borrowing and spending thus curbing inflationary pressure. Whereas, a low repo rate makes borrowing affordable thus, contributing to economic stability and sustainable growth.

The Reverse Repo Rate signifies the interest rate at which the RBI borrows funds from commercial banks. With an increase in the reverse repo rate, banks tend to park more funds with the central bank, thereby reducing liquidity in the system. Conversely, a higher interest rate enhances liquidity in the economy, allowing citizens access to more money for spending.

How does RBI Repo Rate Work?

The repo rate is one of the major tools of monetary policy that directly impacts the inflation rate and loan rate of India. It is decided by RBI in its quarterly meeting considering the economic data. The repo rate impacts the cost at which commercial banks can borrow short-term funds. A higher Repo Rate makes borrowing more expensive, curbing liquidity and potentially reducing inflation. Whereas, a lower Repo Rate affects borrowing, fostering liquidity and encouraging economic activity.

How does RBI Calculate Repo Rate in India?

RBI is the major body that calculates the repo rate in India by using basic tools. The following are the major tools that are considered for calculating the repo rate for a financial year:

- Data Analysis

The RBI conducts thorough research of the data that includes inflation rates, economic growth indicators, fiscal conditions, and global economic factors. The bank uses the available data to assess the current condition of the economy.

- Inflation Targeting

The RBI sets an inflation target by consulting the government. The monetary policy decisions, including the Repo Rate, are guided by the goal of maintaining price stability and keeping inflation within the specified target range.

- Monetary Policy Committee (MPC) Meetings

The RBI in consultation with the government holds bi-monthly meetings to review the economic conditions. The main agenda of the meeting is to discuss inflation, growth rate, and other relevant factors to determine the appropriate monetary policy.

Implications for Borrowers, Investors, and Businesses

The repo rate affects the interest rates at which commercial banks lend money to consumers. When the repo rate increases, the interest rates on home loans and fixed deposits also increase. This leads to higher borrowing costs for consumers and lower demand for loans.

The reverse repo rate is the rate at which the central bank borrows money from commercial banks. When the reverse repo rate increases, commercial banks earn higher returns on their excess funds, which incentivizes them to park more money with the central bank. This reduces the liquidity in the market, making it difficult for corporate borrowers to obtain loans.

How does Repo Rate affect Home Loans?

Repo rate is the interest rate at which banks borrow funds from the Reserve Bank of India (RBI). When the RBI increases the repo rate, banks have to pay more interest to borrow money, which ultimately leads to an increase in the interest rates on home loans. Therefore, an increase in the repo rate makes home loans more expensive, while a decrease in repo rate makes them cheaper.

How does Repo Rate impact Fixed Deposits (FDs)?

When the repo rate increases, banks may offer higher interest rates on fixed deposits (FDs) to attract more funds. Therefore, an increase in the repo rate may lead to higher interest rates on FDs, while a decrease in the repo rate may lead to lower interest rates on FDs.

How does Repo Rate impact the overall economy in India?

The repo rate has a significant impact on the overall economy in India. A decrease in repo rate may lead to lower interest rates on loans, which may increase consumption and investment. This may ultimately lead to economic growth. On the other hand, an increase in repo rate may lead to higher interest rates on loans, which may decrease consumption and investment, leading to slower economic growth.

How Does Repo Rate Affect the Stock Market?

The repo rate, which is the interest rate at which banks borrow money from the central bank, has a significant impact on the stock market. When the repo rate is lowered, banks can borrow money at a cheaper rate, which reduces their borrowing costs and encourages them to lend more money to businesses and consumers. This increase in lending can boost economic growth, leading to higher stock prices. On the other hand, if the repo rate is raised, borrowing costs increase, which can slow down economic growth and lead to a decline in stock prices.

What are the important components of a Repo Transaction?

Here are enlisted the important components of a Repo Transaction:

| Component | Details of Repo Transaction |

| Collateral | Collateral are the securities namely, treasury bills or liquid securities provided by the borrower to the lender. |

| Repo Rate | The Repo Rate is decided by RBI at which the borrower agrees to repurchase the securities. |

| Maturity Date | The Repo rate transaction also consists of a specified date when the borrower must repurchase the securities. |

| Haircut | A haircut is a percentage reduction in the market value of the collateral to account for potential fluctuations in its value during the repo term. |

| Legal Agreements | Formal contracts consist of the terms and conditions of the repo transaction, including details about collateral, repo rate, maturity date, and other relevant terms. |

Role of the Reserve Bank of India

Reserve Bank of India is the apex bank of India which is entrusted with the job of fixing the interest rate, Repo Rate, Reverse Repo Rate, and MCLR. The bank also defines the monetary policy which is used to regulate the economy of a country. Apart from this, RBI is also the banker of the banks and works to circulate currency in the economy.

RBI’s Monetary Policy Committee (MPC) and Its Decision-Making Process

- The RBI formulates the MPC with six members, wherein three are nominated by the government and three from the RBI, including the Governor. They collectively decide on the monetary policy stance and interest rates.

- The primary objective of MPC is to maintain price stability that supports economic growth to meet the inflation target.

- The MPC reviews factors like inflation, growth, and global factors, during bi-monthly meetings to curate the MPC.

Impact of RBI’s Rate Decisions on Financial Markets and Economic Stability

- The decision made by RBI impacts the interest rates across the economy. Higher rates lead to increased borrowing costs, affecting lending rates for consumers and businesses.

- The decision of RBI also affects the stock markets and lower rates encourage investment in equities, while higher rates may lead to a shift away from stocks.

- Higher interest rates attract foreign capital, potentially strengthening the currency, while lower rates might lead to depreciation.

- The low rates prescribed by RBI affect investment while higher rates may have a contractionary effect.

What is the difference between the Repo rate and the MCLR rate?

Go through the table below to learn about the major differences between the Repo Rate and MCLR Rate:

| Repo Rate | MCLR Rate |

| The Repo Rate is the rate at which the central bank lends money to a commercial bank for a short duration. | The minimum interest rate that a bank can charge on loans is determined by the commercial bank considering the operating expense and desired profit margin. |

| The repo rate is used as a tool for controlling money supply, inflation, and monetary policy. | MCLR is a rate that is used by banks to set the lending rates for different loan types. |

| The Repo Rate is set by the RBI through its monetary policy. | The MCLR is determined by the commercial banks based on their cost of funds, operating expenses, and other factors. |

| Changes in the repo rate affect the interest rates in the economy. | MCLR directly influences the interest rates charged by banks on loans. |

How RBI’s Repo Rate Calculation Works:

- Policy Reviews: The RBI periodically reviews its monetary policy in which it decides whether to adjust the Repo Rate. These decisions are made based on current economic conditions, inflation levels, and other macroeconomic indicators.

- Inflation Targeting: If inflation is higher than desired, the RBI may increase the Repo Rate to make borrowing more expensive, which can help slow down consumer spending and inflation.

- Economic Growth: Conversely, if economic growth is slow, the RBI might lower the Repo Rate to make borrowing cheaper, encouraging businesses and consumers to spend and invest more.

- Liquidity Adjustment: The Repo Rate is also used as a tool to manage liquidity in the banking system. By altering the rate, the RBI can influence how much money banks can lend.

Consequences of a Repo Rate Change:

- Loan Interest Rates: An increase in the Repo Rate usually leads to higher interest rates on loans offered by banks to consumers and businesses and vice versa.

Investment: Higher loan interest rates can deter investment by businesses due to the higher cost of borrowing, while lower rates can encourage investment. - Inflation: The RBI can influence inflation as higher rates can help reduce inflation, while lower rates can potentially increase it.

- Currency Value: Increasing the rate can make the Rupee more attractive to foreign investors, potentially increasing its value.

- Savings: The interest rates on savings accounts and fixed deposits can also be influenced by changes in the Repo Rate. Higher rates can lead to higher returns on savings, while lower rates may reduce the returns.

- Stock Market: The stock market can react negatively to an increase in the Repo Rate due to the higher borrowing costs for companies and reduced spending by consumers. Conversely, a decrease in the Repo Rate can boost market sentiment.

- Consumption: Consumer spending can be affected by changes in the Repo Rate, as higher loan costs can lead to reduced spending, while lower costs can increase spending.

What is the Reverse Repo Rate?

The Reverse Repo Rate is prescribed by the Reserve Bank of India in their monetary policy. In layman’s terms, the reverse repo rate is the interest rate at which the central bank borrows the funds from the commercial banks thus offering them the leverage to park their funds. Utilising, the reverse repo rate, a central bank directly manages the liquidity in the financial system thus impacting the borrowing and spending. A Reverse Repo Rate influences the credit and inflation of any country.

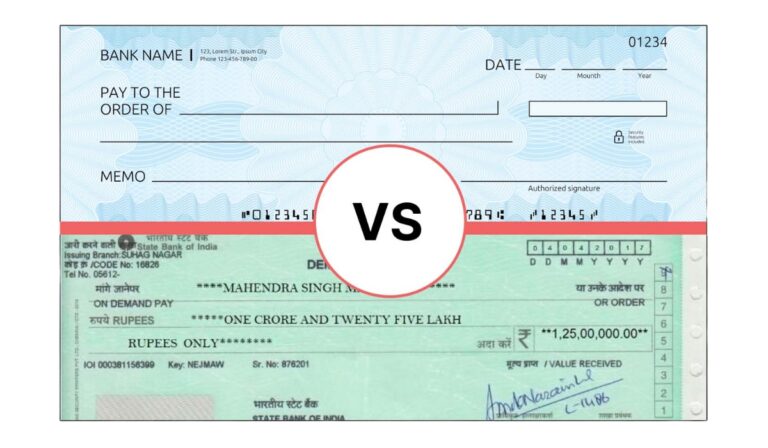

What is the difference between Repo Rate and Reverse Repo Rate?

The following table can be checked to know about the major differences between repo rate and reverse repo rate:

| Repo Rate | Reverse Repo Rate |

| For the Repo rate, the RBI becomes the lender and the commercial bank is its borrower. | For a reverse repo rate, the RBI becomes the borrower and the commercial bank is the lender. |

| The repo rate is fixed to manage the shortfall of the funds. | The major objective of the reverse repo rate is to reduce the money supply in the economy. |

| The interest rate of the repo rate applies to a repurchase agreement. | The interest charge for a reverse repo rate is applicable only for a reverse repurchase agreement. |

| The commercial bank can seek collateral from RBI as government bonds. | The commercial bank deposits its excess funds with RBI and gets interest from the deposits. |

| The funds availed by the commercial bank become expensive with the high-interest rate. | The money supply within the economy is reduced as commercial banks deposit their fund with RBI. |

How does the Repo Rate affect the daily life of an average person?

The RBI increases or decreases the Repo Rate depending on the market conditions. For instance, if the bank increases the repo rate then it will lead to an increase in home loans or auto loans. Since the repo rate is directly proportional to the loan rate, thus it will affect the loan rate. A common man who has taken a loan from the bank will have to pay the increased loan rate thus with an increased EMI.

Example:

For instance, if a person has opted for a home loan equal to 30 lakhs at the interest rate of 10% for 15 years. Then, the EMI will be Rs 32,238. However, if there is an increase of 0.25% in interest, your EMI will rise to Rs 32698.53.

Recent Developments and Future Outlook

Recent adjustments in the Repo and Reverse Repo rates by the Reserve Bank of India (RBI) reflect its efforts to manage inflation and stimulate economic growth. Higher Repo Rates aim to curb inflation by making borrowing costlier, while lower rates are meant to encourage spending and investment by making borrowing cheaper.

Future Outlook:

- Economic Recovery: As India recovers from the pandemic’s effects, the RBI’s rate decisions will focus on balancing growth with inflation control. Incremental rate adjustments may occur based on inflation trends.

- Global Influences: International economic events and policies in other countries could affect RBI’s decisions, especially to maintain currency stability and manage capital flows.

- Domestic Factors: India’s economic indicators, such as GDP growth and consumer spending, will guide future rate adjustments. The goal will be to support economic recovery without triggering inflation.

- Inflation Monitoring: Keeping inflation within the target range remains a priority, influencing future Repo and Reverse Repo rate decisions.

How does the Repo Rate relate to Inflation?

The Central Bank sets the Repo Rate to curb inflation by regulating the cost of borrowing. It has a direct effect on the inflation rate because, when the repo rate is raised, borrowing becomes expensive and eventually the interest rates are also raised for consumers. This leads to reduced spending and investment, curbing demand and potentially lowering inflation. Conversely, a lower Repo Rate encourages borrowing, spending, and investment, stimulating economic activity and potentially contributing to higher inflation.

Frequently Asked Questions (FAQs)

What determines the RBI’s decision on the current repo rate and reverse repo rate adjustments?

Ans: The RBI’s decision on repo rate and reverse repo rate adjustments is based on various economic factors such as inflation, economic growth, and global economic conditions.

How does a change in the repo rate impact personal loans and home loans in India?

Ans: A change in the repo rate impacts personal loans and home loans as it affects the interest rates on these loans. If the repo rate is increased, the interest rate on loans also increases making them more expensive for borrowers.

Why is the reverse repo rate kept lower than the repo rate by RBI?

Ans: The reverse repo rate is kept lower than the repo rate by RBI to encourage banks to lend more to the economy instead of keeping their money idle with the central bank.

What is the current repo rate and reverse repo rate set by the RBI for 2025?

Ans: The current repo rate and reverse repo rate set by the RBI for 2025 are not yet announced as the RBI reviews and adjusts these rates periodically based on economic conditions.

What happens to my savings account when the RBI modifies the reverse repo rate?

Ans: When the RBI modifies the reverse repo rate, it can impact the interest rates offered by banks on savings accounts. If the reverse repo rate is increased, the interest rates on savings accounts may also increase.

How do repo rate hikes help control inflation in India?

Ans: Repo rate hikes help control inflation in India by making borrowing more expensive, which reduces demand for loans and thereby reduces the overall demand in the economy.

What are the implications for the Indian economy if the RBI continually adjusts the repo rate?

Ans: The adjustments to the repo rate by the RBI can have significant implications for the Indian economy, including affecting economic growth, inflation, and the availability of credit.

Can changes in the repo rate benefit investors in any way?

Ans: The changes in the repo rate can benefit investors in some ways, such as by increasing the returns on fixed deposits and other savings instruments.

How do repo and reverse repo rates affect the availability of credit in the market?

Ans: The Repo and reverse repo rates affect the availability of credit in the market by influencing the interest rates at which banks lend and borrow money.

What is the relationship between the repo rate and the bank rate?

Ans: The bank rate is the rate at which the RBI lends to commercial banks, while the repo rate is the rate at which commercial banks borrow from the RBI. Therefore, there is a direct relationship between the repo rate and the bank rate.

Also, check: