Imagine you’re walking through your neighbourhood and notice a broken pipe gushing water into your neighbour’s yard while they’re away on vacation. Without a second thought, you call a plumber and pay for the repair to prevent further damage. When your neighbour returns, they’re grateful but hesitant to reimburse you for the expense. This is where the concept of quasi contracts comes into play.

Quasi Contracts are applicable in situations wherein one-party benefits unjustly from another’s loss, despite the absence of a formal agreement. It saves people in situations where traditional contract law may not apply due to the lack of mutual consent. Quasi contracts serve as a safeguard promoting equitable outcomes and ensuring that businesses do not promote injustice.

In this blog, we’ll talk about what they are, how they work in the law, and why they’re important for making sure people deal with each other fairly, even when they don’t have a clear agreement.

What is a Quasi Contract? (Meaning)

In legal terms, “quasi” means something that seems to be one thing but isn’t quite that. The concept was created to stop unfair situations. In layman’s language, it is not an actual contract and lacks a mutual agreement, but is a legal remedy that helps to rectify situations where one person benefits from someone else’s loss without having an official agreement.

The Court of Law invokes quasi-contract in situations wherein there is no formal contract exists between two parties but a compensation settlement has to be done. Now, since there is no legal law, hence a quasi contract helps to evoke fairness and prevents a loss or expense to any party.

The term “Quasi” means that the agreement resembles a true contract but it lacks mutual consent. The Quasi-Contract is evoked in a situation wherein there is no formal agreement. Therefore, the court applies this law to prevent one party from unjustly benefiting at the expense of another. The major benefit of this contract is that it resolves injustice and offers justice in situations not covered by explicit agreements.

How does a Quasi-Contract work?

Unlike standard contracts formed by mutual consent of the parties involved, a quasi-contract is imposed by law under circumstances where one party acquires something of value at the expense of another without the legal basis for keeping it. The quasi-contract section in business law is designed to remedy situations lacking mutual agreement, but where justice demands a contractual obligation to ensure fairness and equity.

The process of implementing a quasi-contract typically unfolds within court judgments when a party seeks restitution for benefits unjustly received by another. Courts evaluate the situation to determine if one party has been enriched unjustly at the expense of another, and if there is no existing contractual relationship that justifies such enrichment. If these conditions are met, the court may impose a quasi-contractual obligation, requiring the enriched party to compensate the other, essentially creating a contract where none existed before.

Features of Quasi Contracts

The following are the major features of section 71 of the Indian Contract Act that make it a prerequisite for businesses:

- Quasi contracts arise when a person provides a benefit to another without the latter’s consent. This benefit may be conferred unintentionally or due to circumstances.

- Quasi contracts come into play when there is no voluntary agreement or contract between the parties involved. The obligations are imposed by law to address the lack of a formal agreement.

- The primary purpose of quasi contracts in Section 71, is to prevent unjust enrichment. It ensures that the party receiving the benefit without consent is obligated to make restitution.

- Section 71 establishes that the remedy for quasi contracts often involves restitution. The person unjustly enriched is required to restore or compensate for the benefit received aligning with the overarching principle of fairness and preventing unjust gain.

How Quasi-Contracts Arise According to Section 71 of the Indian Contract Act

The main aim of quasi contracts of the Indian Contract Act is that it helps a person who is benefitted at the expense of other in the absence of a formal contract. The following are the major reasons for evoking Section 71 of the Indian Contract Act:

- Quasi Contracts can be revoked for that person who offers financial benefit to another with an expectation of compensation.

- Section 71 implies a promise to compensate when one party confers a benefit upon another. Even though there is no explicit agreement, the law can help the beneficiary with the required compensation.

Quasi Contract Examples in Real Life

A quasi-contract is a legal concept used to impose obligations that arise from a contract in the absence of a formal agreement. This is based on the principle that ensures fairness, wherein one party benefits at the expense of another.

Example:

To understand this more clearly, let’s assume that A and B enter a contract under which B agrees to deliver a basket of fruits to A for a total cost of Rs 1500. However, B delivered the fruit basket to C instead unknowingly considering it a birthday gift. C assumed it was a birthday gift and consumed it. Now, he is obliged to pay the price of the fruit basket even though it was delivered unknowingly yet evoking quasi contract makes it a valid transaction.

Types of Quasi Contracts

There are several types of quasi contract for different needs, the following section can be checked to get a gist of the same-

Section 68

Under this Section, a person who is not of sound mental or physical health will be obligated to pay the price to the supplier. For example, X and Y are two people and the former does not have mental sanity. However, if Y has supplied X anything then he is eligible to get paid.

Section 69

When an individual covers a cost for someone else, they are legally bound to make the payment. Consequently, this individual has the right to seek repayment from the party on whose behalf the expense was incurred.

Section 70

When an individual performs an action or provides something to another person legally, without the intention of doing so for free, the recipient is required to provide compensation to the individual who provided the service or item.

Section 71

A person who comes across items that are owned by someone else and assumes possession of them bears similar obligations to those of a bailee.

Section 72

An individual who receives payment or goods due to forceful persuasion or by mistake is obligated to reimburse or restore the amount or item received.

Also, check: How to get ₹1 Lakh Personal Loan

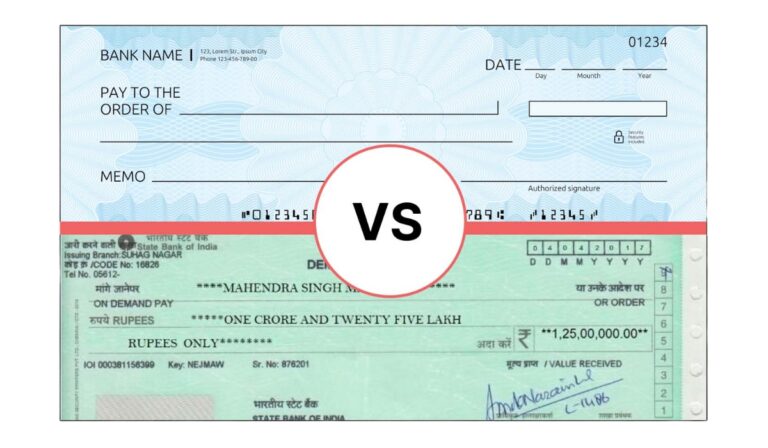

Difference Between Contract and Quasi Contract

The following table covers all the aspects of a contract and quasi-contract in depth, along with their major differences –

| Aspect | Contract | Quasi Contract |

| Formation | A normal contract is formed after the mutual consent of two parties. | The quasi contract is not created by the consent of two parties but comes into existence citing law. |

| Consent | Both parties have to give their consent to create a contract. | The creation of this contract does not require any consent between parties. |

| Elements | The major elements of a contract are offer, acceptance, consideration, and intention to create a legal obligation. | The basic element of a quasi contract is a benefit conferred, the recipient’s awareness, and the absence of voluntary consent. |

| Enforceability | A simple contract is fully enforceable by law with specific terms | Enforceable to prevent unjust enrichment, terms imposed by law |

| Voluntariness | Parties willingly enter into a contractual relationship | No voluntary agreement between parties but obligations have to be imposed by law |

The Role of Section 71 of the Indian Contract Act in Quasi Contracts

As per Section 71 of the Indian Contract Act, of 1872, one can deal with the principle of restitution if they confer benefit over another party without their consent. It states that the person receiving the benefit is bound to restore or compensate the person bestowing the benefit. By incorporating this section, the Indian Contract Act acknowledges the need for fairness and restitution when parties unintentionally confer benefits in the absence of a formal contract.

The following are the major applications of Section 71 in Quasi Contracts, making it an important aspect for business:

- Section 71 can be invoked if there is an emergency and one needs medical assistance without a prior agreement. However, the recipient of the assistance is obliged to compensate the person who offers him the treatment

- Section 71 can also be applied if a person wishes to protect other parties’ properties in the absence of an agreement. The party benefiting from the protection is obligated to compensate the protector for their efforts

- In cases where a person mistakenly pays the debt of another, believing it to be their obligation, Section 71 can be invoked. The person who received the accidental payment is required to reimburse the payer as the benefit was not intended as a gift

Use of Quasi Contracts in Business Law

Quasi-contracts play a pivotal role in business law as they help to do justice if either of the parties is facing any legal complication. For instance, when a supplier inadvertently delivers goods without a specified contract, a quasi contract may be invoked to ensure fair compensation.

It helps to address any gaps and offer relevant remedies to prevent injustice. By applying quasi-contracts, business law aims to maintain fairness and uphold equitable principles.

Elements Necessary for a Quasi Contract (Essentials)

The following are the relevant elements that should be considered when drafting a quasi contract:

- Benefit

The first essential element of a quasi contract is a benefit conferred by one party to another. Some of the major factors include the provision of goods or services. One has to mention the benefit that led to the creation of quasi contract.

- Recipient’s Awareness

The party benefited from the quasi contract is also imperative. The awareness includes transparency in the transaction for rendering the services to the recipient.

- Absence of Voluntary Consent:

The third essential element revolves around the absence of voluntary consent between the parties involved. In quasi contracts, there is no explicit agreement or contractual understanding between the benefactor and the recipient.

- Purpose

This legal concept aims to ensure that one party does not unfairly benefit at the expense of another without a valid contract in place.

Quasi-contractual obligations arise in situations wherein there is no mention of a formal contract but one party benefits at the other’s expense. Hence, to install fairness and transparency, one needs legal prerequisites as it confers a benefit to the defendant by preventing injustice events in the absence of a formal agreement.

Quasi Contracts Notes for Students and Practitioners

The concept of quasi contracts is an essential topic for both law students and legal practitioners. This area of law helps address situations where there’s no formal contract between parties, but one party has received a benefit that would be unjust for them to retain without compensating the other party.

Key Takeaways

- Preventing Unjust Enrichment: The core principle behind quasi contracts is to prevent unjust enrichment. It’s about ensuring that no one benefits unfairly at someone else’s expense without making proper restitution.

- Court-Imposed Obligations: These obligations are created by the court to correct unjust situations. This means that even without a formal contract, the law can require one party to pay the other as if there was a contract.

- Legal Remedy: Quasi contracts provide a legal remedy for the aggrieved party. This is crucial in cases where traditional contract law does not offer a solution due to the absence of mutual consent.

For Educational Purposes

For students learning about quasi contracts, it’s important to grasp the balance between legal theory and practical application. Understanding how quasi contracts work illuminates a vital aspect of contract law that ensures equitable treatment for parties involved in non-contractual exchanges.

For Practitioners

Legal practitioners use the concept of quasi contracts to resolve disputes where one party has received a benefit without a formal agreement. It’s a tool for ensuring that fairness prevails in the absence of explicit contractual agreements.

Avoiding Quasi-Contractual Disputes

One of the best ways to avoid quasi-contractual disputes is to establish clear agreements from the beginning. One should mention things like terms, roles, and responsibilities in the quasi-contract. Additionally, one should communicate with the involved parties to address any misunderstandings.

The following are the best practices to avoid quasi contractual disputes:

- Define Scope and Deliverables Clearly

- Use Defined Terms and Interpretation Provisions

- Add an Integration Clause to your Quasi Contract

- Do not write your Quasi Contract in a general or vague language

Conclusion

On a final note, quasi-contracts are like safety nets in the legal realm that come into effect in the absence of an informal agreement. It brings justice in cases wherein a person receives any benefit unknowingly and obliges them to pay for it. This contract also prevents unfair gains acting as a fair backup even without a written deal.

Frequently Asked Questions (FAQs)

- What is a quasi contract and how does it differ from a regular contract? (Difference

between contract and quasi contract)

Ans. A quasi contract is a legal concept where the court imposes an obligation resembling a contract despite the absence of a formal agreement to prevent unjust enrichment.

- Can you provide an example of a quasi contract in action? (Quasi contract example)

Ans. If someone mistakenly delivers goods to the wrong address, the recipient may be obligated to return or pay for the goods under a quasi contract.

- What section of the Indian Contract Act deals with quasi contracts? (Section 71 of Indian Contract Act)

Ans. Section 68 to 72 of the Indian Contract Act of 1872, deals with quasi contracts, with Section 68 specifically addressing “Claim for necessaries supplied to a person incapable of contracting.”

- What are the mandatory elements for the existence of a quasi contract? (Essentials of quasi contract)

Ans. The mandatory elements for a quasi contract include the enrichment of one party, the impoverishment of another, the absence of a legal ground for enrichment, and the absence of a contract.

- In what ways can quasi contracts be beneficial in business? (Quasi contract in business law)

Ans. Quasi contracts is beneficial in business by providing remedies in situations where a formal contract is lacking, preventing unjust enrichment, and promoting fairness.

- How can one avoid the unintended creation of a quasi contract?

Ans. To avoid unintended quasi contracts, it is crucial to have clear written agreements explicitly stating terms and conditions.

- Are there different types of quasi contracts? If so, what are they? (Types of quasi

contract)

Ans. The different types of quasi contracts include contracts for necessities, payment by an interested person, obligation to pay for non-gratuitous acts, and money paid by mistake.

- What legal actions can ensue if a party refuses to comply with a quasi-contract?

Ans. Legal actions for non-compliance with a quasi contract may include a lawsuit to recover unjustly gained benefits or specific performance of obligations imposed by the quasi contract.

- Can quasi-contracts be entirely avoided with comprehensive written agreements?

Ans. While comprehensive written agreements can minimise the likelihood, certain circumstances may still lead to quasi-contractual obligations.

Under what circumstances are quasi-contracts typically employed?

Ans. Quasi contracts are typically employed when someone benefits at the expense of another without a formal contract, such as in emergencies or cases involving mental incapacity.

Also, check: