Basics of Credit Card:

Finance experts spend a lot of energy trying to prevent us from using credit cards. However, contrary to popular belief, if you can use the card responsibly, you’re actually much better off paying with a credit card than with a debit card and keeping cash transactions to a minimum.

A credit card can be used to transfer money/make a payment by:

- Swiping it at merchants POS terminals/machines.

- Can also be used to pay money online through web portals/payment gateways hosted by authorized agencies.

However, one cannot transfer money through credit card online to one’s landlord directly.

You ask me why?

In order to pay directly to the landlord, he/she must have his/her own authorised web portal, which has to be linked to a payment gateway, to do so.

A payment gateway helps in facilitating payment transactions by the transfer of information between a payment portal and the acquiring bank.

Recently PayMe India App has launched its latest feature Pay Rent which facilitates rent transfers using a Credit Card.

Their instructions say “You can simply enter the monthly rent you wish to pay. Fill in the details of your landlord’s bank account. Add your address for which you’re paying rent and submit. Your rent will be paid and they’ll charge you a nominal fee for the service.”

They have a sleek interface, neat and clean feature and known for their low service rate. They stay dedicated to the solution.

According to Payme India “They are also providing a processing fee waive of upto 500 rupees in your next loan with PayMe India on a minimum transaction of 30,000 rupees using pay rent feature.”

Let’s talk about few of the advantages of paying via credit card:

Rent is probably one of the biggest expenses borne by individuals on a monthly basis. Payme India’s ‘Pay Rent’ feature will allow users to maintain their liquidity if needed over the next couple of months by using their credit cards for rent transfers as it allows flexibility in repayment.”

REWARDS:

Your credit card rewards options are almost endless. The trick is to find the card that best fits with your spending patterns.

SAFETY:

Paying with a credit card also makes it easier to avoid losses from fraud. When your debit card is used by a thief, the money is missing from your account instantly. By contrast, when your credit card is used fraudulently, you aren’t out of any money, you just notify your credit card company of the fraud and don’t pay for the transactions you didn’t make.

GRACE PERIOD:

Grace period you get while paying from credit cards can be of so much use especially in today’s conditions.

Hanging on to your funds for this extra time can be extremely helpful.

CREDIT SCORE:

Using a credit card responsibly can help you in improving your credit score. Credit card companies will report your payment activity to the credit bureaus. Improved credit score helps you massively in future lending’s if you need any.

Conclusion:

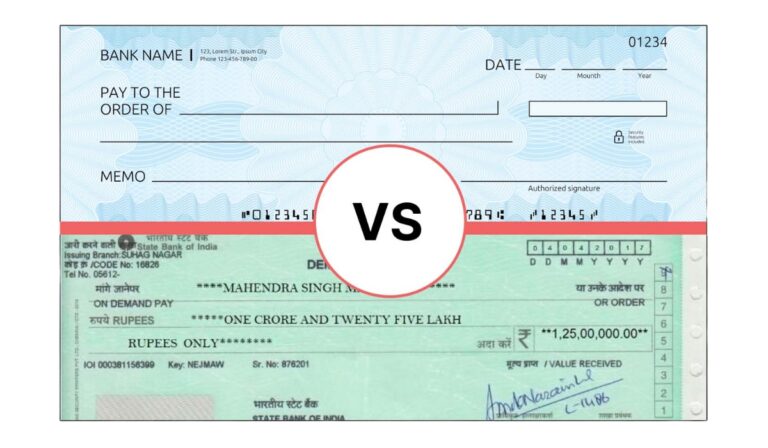

If you’re a disciplined individual, who can remain aware of their ability to pay the monthly bill on or before the due date, you’re surely going to enjoy paying through your credit cards. Not only monthly rent, you can try to push other purchases to credit cards as well because if you do responsibly, the combination of rewards, the value of liquidity in hand and buyer protection will put you ahead of those who pay with debit, check or cash.