Employees’ Provident Fund (EPF): These funds are run by the Employees’ Provident Fund Organization (EPFO). This is an obligatory retirement savings plan for the country’s workers. Both employees and employers contribute to the fund, which can be withdrawn when the person retires or according to their requirements under specific conditions.

Permanent Account Number (PAN): The Income Tax Department of India issues a ten-digit alphanumeric identifier known as PAN. This plays a vital role in many things like tracking financial transactions, filing income tax returns, and also in preventing tax evasion.

Importance of Linking PAN with EPF in 2025

- Tax Benefits: Ensures appropriate tax treatment of EPF withdrawals by avoiding higher TDS rates.

- Easier claiming process: Facilitates quick and accurate processing of EPF withdrawal claims.

- Regulatory Compliance: Transparent financial transactions

- Fraud Prevention: Helps in reducing and preventing fraudulent activities by linking EPF accounts to verified identities.

- Simplified KYC: Makes account management easier by simplifying the whole KYC process.

What is an Employees’ Provident Fund (EPF)?

In India, the Employees’ Provident Fund (EPF) is a retirement savings scheme managed by the Employees’ Provident Fund Organization (EPFO). It is compulsory for employees in the organized sector, where both employees and employers contribute a portion of the employee’s salary to this fund. The accumulated amount earns interest and this amount can be easily withdrawn upon retirement, resignation, or under specific conditions that fall under the guidelines set by EPFO.

Linking PAN with EPF: A Way for Instant Loan Application

Linking PAN with EPF is considered important, not only for tax and regulatory purposes but also because it facilitates instant loan applications using EPF.

Process of Applying for Loans Using EPF

- PAN Linking: Make sure that your PAN is linked with your EPF account through the EPFO portal.

- Loan Application: To apply for a loan against your EPF balance, you can navigate through the EPFO portal or your financial institution’s website

- Verification: If your provided information is accurate, then your PAN-linked EPF account gets verified for loan eligibility.

- Approval: Once verified, the loan gets approved based on the EPF balance and other criteria.

- Disbursement: The loan amount is then directly disbursed to your bank account.

Benefits of PAN Linking for Instant Loan Applications

- Faster Processing:

- Linking PAN ensures quicker verification and approval of loan applications.

- Higher Loan Amount:

- Accurate verification of EPF balance allows for higher loan amounts.

- Reduced Documentation:

- Simplifies the application process by reducing the need for additional documents.

- Improved Eligibility:

- Ensures compliance with eligibility criteria, improving the chances of loan approval.

Steps to Link PAN with EPF Account Online

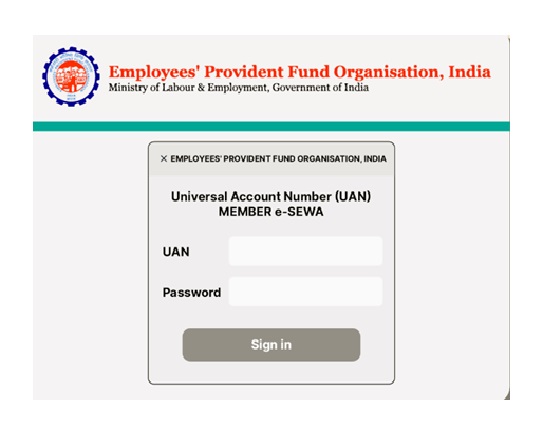

Step 1: Visit the EPFO Member Portal

- Open your web browser and go to the EPFO member portal: EPFO Member Portal.

- Type your UAN (Universal Account Number), password, and captcha.

- Select “sign in” from the menu.

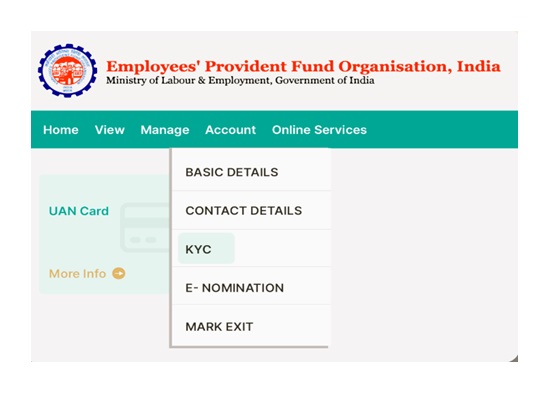

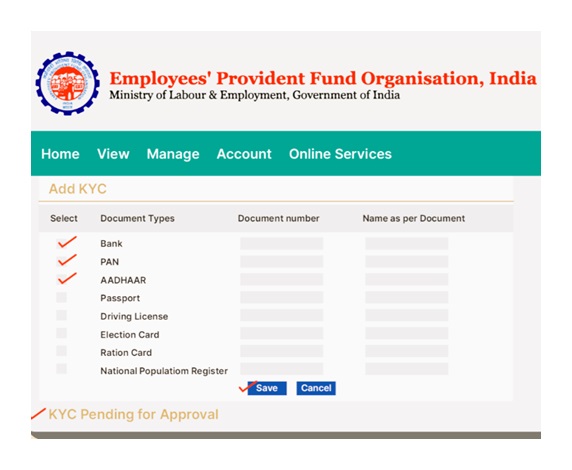

Step 2: Visit to the ‘Manage’ Section

- Once you log in, go to the “Manage” tab in the menu.

- Click “KYC” from the dropdown.

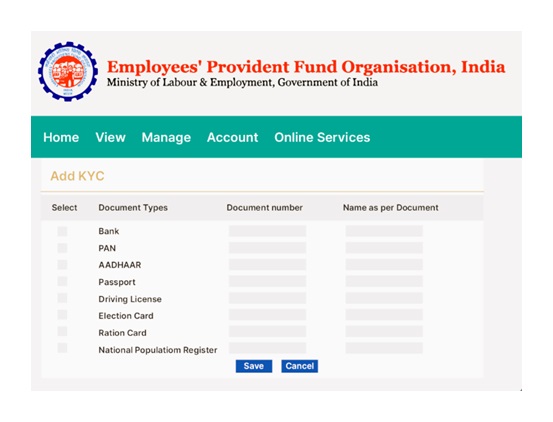

Step 3: Fill Your PAN Details

- In the KYC section, you will see various document options.

- Select the checkbox for PAN.

- Enter your PAN number in the provided field.

- Your name as per PAN will be automatically populated (ensure it matches your EPF account details).

Step 4: Save the Details

- After entering the PAN details, click on the “Save” button.

- Your PAN details will now be saved and sent for approval.

Step 5: Verify Your PAN Status

- After saving, the status of your PAN linking will be shown as “Pending for Approval”.

- Once the employer and EPFO verify your details, the status will change to “Verified”.

Steps to Link PAN with EPF Account Offline

- Go to your closest EPFO branch and request an EPF-PAN connecting form from the relevant official.

- As requested, complete all the required fields such as your PAN, UAN, name, etc. in the form

- Self-attest a copy of your PAN Card and UAN and submit it along with the EPF-PAN linking form

- After submission of these above documents, your application will be verified; post the approval of which, your PAN will be linked to your EPF account

- You will receive a notification on your mobile number and email ID regarding your PAN-EPF linking.

What are the Benefits of Having an EPF Account?

- Retirement Savings

-

- Long-term Savings: Build up a sizeable corpus over time to ensure your financial security after retirement.

- Regular Contributions: Both employees and employers contribute, ensuring ongoing growth.

- Tax Benefits

-

- Tax-free Interest: Up to certain limits, interest earned is tax-free.

- Exemption of Withdrawals: Tax-free withdrawals After five years of continuous service Tax-free withdrawals are available

- Financial Security

-

- Risk-free Investment: Government-backed, safe and secure.

- Pension Benefits

-

- EPS: Provides pension benefits post-retirement for a regular income stream.

- Retirement Social Security

-

- Helps During Unemployment: Financial aid through partial withdrawals.

- Unpredictable Funds: Provides financial support during unexpected circumstances.

Avail Yourself of the Maximum Financial Benefits Through EPFO PAN Card Update!

Benefits of Linking PAN with EPF

-

- Lower TDS: If your PAN is linked, EPF withdrawals before 5 years of service attract a TDS of 10%. Without PAN, TDS can be as high as 34.608%.

- Quick Processing: Linking PAN helps in quick verification of your identity, leading to faster processing of withdrawal claims to Reduce discrepancies and errors

- Easy Loan Approval: Linking PAN simplifies the loan application process against your EPF balance, facilitating quicker approvals and eligibility for the higher loan amount

Conclusion

In conclusion, an employee provident fund account offers long-term savings, benefits from tax and a guarantee of returns on financial security. Also, it provides a wide range of benefits to employees for their financial security and stability and provides facilities for partial withdrawals and low-interest loans, enhancing financial flexibility.

EPF Accounts are completed social security tools because they provide pension and insurance benefits

The portability of EPF accounts through UAN and the convenience of online services simplify account management and ensure smooth transitions between jobs. Regular contributions encourage a disciplined savings habit, while the compounded growth of funds ensures financial support in the future.

Overall, an EPF account is an important component of financial planning for employees, providing immediate and long-term benefits that contribute to overall well-being.

Also, check:

- How to Detect PAN Card Fraud and Steps to Report Misuse

- Check TDS Status by PAN Card

- How to check CIBIL Score Online without PAN Card

- How Do I Change Address in PAN Card Online?